Pricing

VAT and sales tax are not included in the price. The additional amount will depend on the country or state provided upon purchase.

However, for the majority of the countries, the VAT / sales tax will be removed during checkout after you provide your tax ID.

For more details find your country in the table below:

| Country/State | Tax Rate, % | Indirect Tax | B2B Customers exempt? |

| Armenia | 20% | VAT | Yes |

| Australia | 10% | GST | Yes |

| Bahamas | 10% | VAT | No |

| Bahrain | 10% | VAT | Yes |

| Cameroon | 19.25% | VAT | No |

| Chile | 19% | VAT | Yes |

| Colombia | 19% | VAT | Yes |

| Georgia | 18% | VAT | Yes |

| Ghana | 15% | VAT | Yes |

| Iceland | 24% | VAT | No |

| India | 18% | GST | Yes |

| Indonesia | 11% | VAT | No |

| Japan | 10% | Consumption Tax | No |

| Kazakhstan | 12% | VAT | No |

| Kenya | 16% | VAT | No |

| Liechtenstein | 8.10% | VAT | No |

| Malaysia | 6% | SST | No |

| Mexico | 16% | VAT | No |

| Moldova | 20% | GST | Yes |

| New Zealand | 15% | GST | Yes |

| Nigeria | 7.50% | VAT | No |

| Norway | 25% | VAT | Yes |

| Oman | 5% | VAT | No |

| Saudi Arabia | 15% | VAT | Yes |

| Singapore | 9% | GST | Yes |

| South Africa | 15% | VAT | No |

| South Korea | 10% | VAT | Yes |

| Switzerland | 8.10% | VAT | No |

| Taiwan | 5% | VAT | Yes |

| Tanzania | 18% | VAT | Yes |

| Thailand | 7% | VAT | Yes |

| Turkey | 20% | VAT | Yes |

| United Arab Emirates | 5% | VAT | Yes |

| Uganda | 18% | VAT | Yes |

| Ukraine | 20% | VAT | Yes |

| United Kingdom | 20% | VAT/ VAT OSS | No |

| Uzbekistan | 12% | VAT | Yes |

| Vietnam | 11.11% / 17.65% | FCT | No |

| Canada | |||

| Alberta | 5% | Federal GST | Yes |

| British Columbia | 7% + 5% | PST + Federal GST | No |

| Manitoba | 7% + 5% | RST + Federal GST | Yes |

| New Brunswick | 15% | Federal HST | Yes |

| Newfoundland and Labrador | 15% | Federal HST | Yes |

| Northwest Territories | 5% | Federal GST | Yes |

| Nova Scotia | 15% | Federal HST | Yes |

| Nunavut | 5% | Federal GST | Yes |

| Ontario | 13% | Federal HST | Yes |

| Prince Edward Island | 15% | Federal HST | Yes |

| Quebec | 9.975% + 5% | QST + Federal GST | Yes |

| Saskatchewan | 6% + 5% | PST + Federal GST | Yes |

| Yukon | 5% | Federal GST | Yes |

| EU Countries | _ | _ | _ |

| Austria | 20% | VAT OSS | Yes |

| Belgium | 21% | VAT OSS | Yes |

| Bulgaria | 20% | VAT OSS | Yes |

| Croatia | 25% | VAT OSS | Yes |

| Cyprus | 19% | VAT OSS | Yes |

| Czech Republic | 21% | VAT OSS | Yes |

| Denmark | 25% | VAT OSS | Yes |

| Estonia | 22% | VAT OSS | Yes |

| Finland | 24% | VAT OSS | Yes |

| France | 20% | VAT OSS | Yes |

| Germany | 19% | VAT OSS | Yes |

| Greece | 24% | VAT OSS | Yes |

| Hungary | 27% | VAT OSS | Yes |

| Ireland | 23% | VAT | Yes |

| Italy | 22% | VAT OSS | Yes |

| Latvia | 21% | VAT OSS | Yes |

| Lithuania | 21% | VAT OSS | Yes |

| Luxembourg | 17% | VAT OSS | Yes |

| Malta | 18% | VAT OSS | Yes |

| Netherlands | 21% | VAT OSS | Yes |

| Poland | 23% | VAT OSS | Yes |

| Portugal | 23% | VAT OSS | Yes |

| Romania | 19% | VAT OSS | Yes |

| Slovak Republic | 20% | VAT OSS | Yes |

| Slovenia | 22% | VAT OSS | Yes |

| Spain | 21% | VAT OSS | Yes |

| Sweden | 25% | VAT OSS | Yes |

| United States* | _ | _ | _ |

| Alabama | 4% | Sales Tax | No |

| Arizona | 5.60% | Sales Tax | No |

| Arkansas | 6.50% | Sales Tax | Yes |

| Colorado | 2.90% | Sales Tax | No |

| Connecticut | 6.35% | Sales Tax | No |

| Denver | 4.81% | Sales Tax | No |

| District of Columbia | 6% | Sales Tax | No |

| Hawaii | 4% | Sales Tax | No |

| Idaho | 6% | Sales Tax | No |

| Illinois | 6.25% | Sales Tax | Yes |

| Indiana | 7% | Sales Tax | No |

| Iowa | 6% | Sales Tax | No |

| Kansas | 6.50% | Sales Tax | No |

| Kentucky | 6% | Sales Tax | No |

| Louisiana | 4.45% | Sales Tax | No |

| Maine | 5.50% | Sales Tax | No |

| Maryland | 6% | Sales Tax | No |

| Massachusetts | 6.25% | Sales Tax | No |

| Michigan | 6% | Sales Tax | Yes |

| Minnesota | 6.88% | Sales Tax | No |

| Mississippi | 7% | Sales Tax | No |

| Nebraska | 5.50% | Sales Tax | No |

| New Jersey | 6.63% | Sales Tax | No |

| New Mexico | 5.13% | Sales Tax | No |

| New York | 4% | Sales Tax | No |

| North Carolina | 4.75% | Sales Tax | No |

| North Dakota | 5% | Sales Tax | Yes |

| Ohio | 5.75% | Sales Tax | No |

| Pennsylvania | 6% | Sales Tax | No |

| Rhode Island | 7% | Sales Tax | No |

| South Carolina | 6% | Sales Tax | No |

| South Dakota | 4.50% | Sales Tax | No |

| Tennessee | 7% | Sales Tax | No |

| Texas | 8% | Sales Tax | No |

| Utah | 4.85% | Sales Tax | No |

| Vermont | 6% | Sales Tax | Yes |

| Washington | 6.50% | Sales Tax | No |

| West Virginia | 6% | Sales Tax | No |

| Wisconsin | 5% | Sales Tax | No |

| Wyoming | 4% | Sales Tax | No |

GA Connector price doesn’t depend on the number of users, it’s the same for the whole organization.

We only offer discounts when GA Connector licenses are purchased in bulk (5 or more). In other cases, we don’t offer any discounts (including non-profits).

It all comes down to the return on your investment. There are two ways GA Connector can generate substantial ROI for you:

- It saves you money helping you see which marketing efforts are not profitable

- It makes you money by showing you which campaigns generate the highest revenue, so you can double down on your best-performing channels

When GA Connector helps you add $1000-$3000 to your profits, you’d have already paid for an entire year using the tool (depending on the plan). For many of our customers, this only takes a few extra sales which can be easily achieved by doubling down on your most profitable campaigns.

GA Connector offers several pricing plans, depending on how much traffic your website gets. You can check out our plans here.

All plans one CRM account and multiple domains (with unlimited subdomains). If you want to integrate multiple CRM accounts, you need to purchase multiple subscriptions.

If you’re using Salesforce or Zoho CRM, for an extra charge we offer an add-on: importing CRM data back into Google Analytics (base plan only supports GA to CRM data flow).

Making a purchase

You can purchase GA Connector here.

We accept two types of payments:

- All major credit and debit cards (including Mastercard, Visa, Maestro, American Express, Discover, Diners Club, JCB, UnionPay, and Mada)

- PayPal

Unfortunately, we do not support wire transfers.

Cancellation

You can cancel GA Connector subscription in our dashboard.

If you’re having issues with cancellation, please contact support.

If you purchased GA Connector a while back using our previous payment processing solution 2Checkout, use this instruction.

Yes, we have a 30-day refund policy. If the purchase was made by mistake, or there is an issue with the integration, we provide a full refund.

Legacy billing (2checkout)

The steps are as follows:

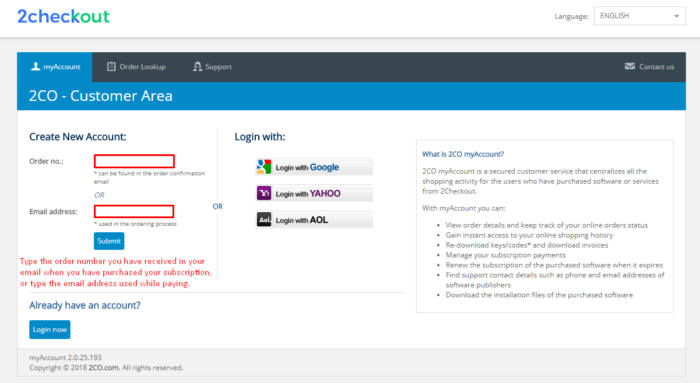

1. Log into your 2checkout account here: https://secure.2co.com/myaccount/

2. Access the “My products” tab at the top of the account

3. Click the appropriate link for the subscription you need to be updated:

4. A pop-up will be shown where the new card information can be typed in.

GA Connector previously used a payment processing solution called 2Checkout to bill you. If you purchased GA Connector via 2Checkout, you need to take the following steps:

- Go to https://secure.2co.com/myaccount/

- Enter the order number or the email address you have used to pay and click Submit.

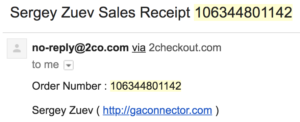

- Here is how you can find 2CO Order Number and the email you used during the payment:

Search for an email from [email protected] with a subject “Sergey Zuev Sales Receipt …”. It should look like this:

If you can’t find this information, please let us know. - You will receive an email from 2checkout to setup your account.

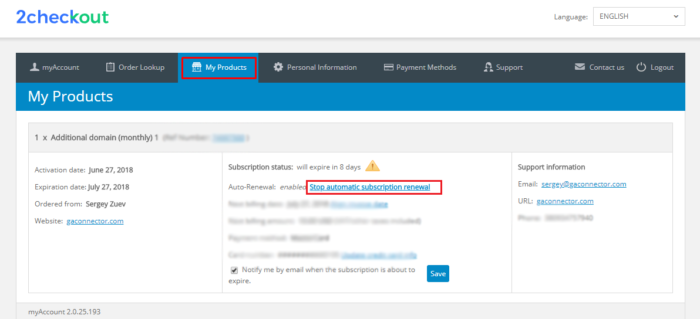

- This 2checkout UI will appear, click on My Products

- Click Stop automatic subscription renewal link.

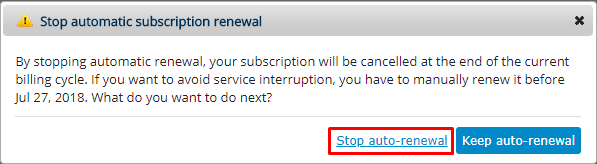

- The image below will show up. Click Stop auto-renewal

- Click Save.