Likes, comments, shares, and click-through rate on a Facebook ad are sometimes deceptive. While Facebook offers these metrics that tell a lot about the quality of your content and how to gauge your target audience’s interests, making a decent Facebook ROI (return on ad spent) from Facebook ad campaigns is beyond social engagement.

And how to properly measure the Facebook ad ROI, you ask? I’m going to give you a step-by-step walkthrough right away!

How to Calculate ROI on FB Ads

Note: I find this method the most convincing because as a marketer (or a business owner), you already have free access to Google Analytics, and Facebook Ads Manager even if you’re a complete beginner. There are other ways to do it but that requires some level of paid subscription.

Step 1:

Log in to your Google Analytics account.

Step 2:

Navigate to the menu.

Step 3:

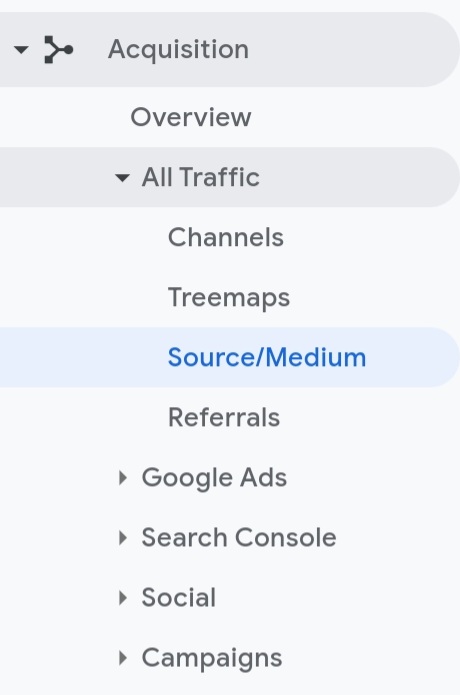

Navigate to Acquisitions > All Traffic > Source/Medium.

Step 4:

Change the range of source/medium to last month.

Step 5:

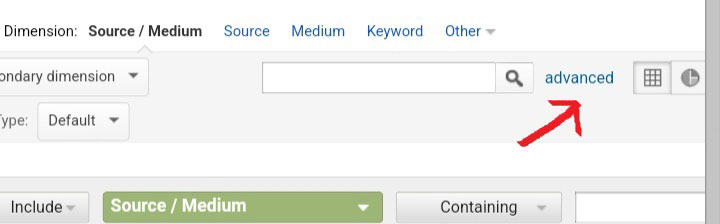

Filter out the Facebook and Instagram referrers by using the keywords facebook/instagram in the advanced reporting filter.

Step 6:

Note down the last direct sales from Facebook (aka total revenue generated).

Step 7:

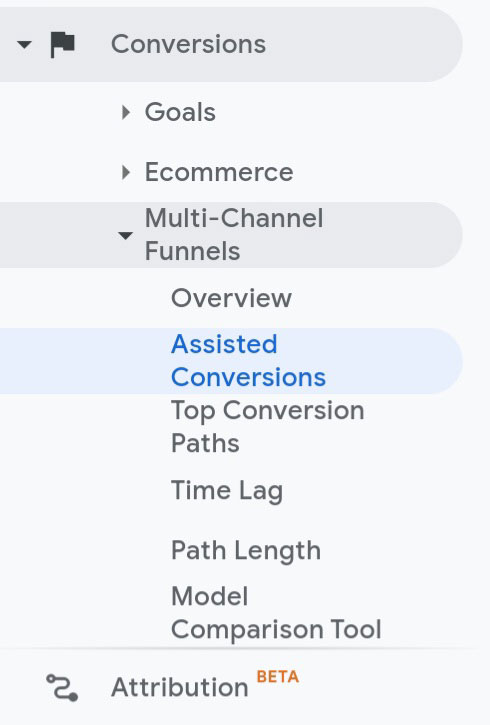

Go to Conversions > Multi-Channel Funnels > Assisted Conversions.

Step 8:

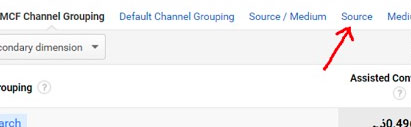

Read the options and select ‘Source’.

Step 9:

Filter the Instagram and Facebook URLs in the advanced reporting filter: facebook/instagram and check the Assisted Conversion Value.

Assisted Conversion is your customer’s final action after they see an ad. They come back later to your Facebook page, and then visit your landing page to buy a product. Since Facebook assisted this sale, hence the name assisted conversion.

Step 10:

Now head over to your Facebook Ads Manager and set the date to last 30 days.

Step 11:

If you’ve more than one Facebook ad campaigns running, see the total amount spent in the last 30 days on all Facebook campaigns.

Step 12:

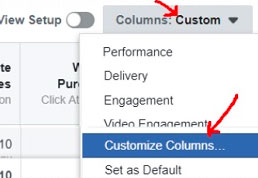

Inside Facebook Ads Manager, select Columns > Customize Columns.

Step 13:

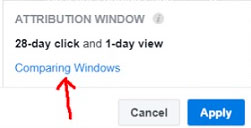

Click on Comparing Windows.

Step 14:

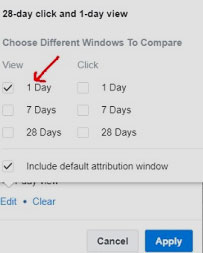

If you’re going all in Facebook marketing alone, then mark the 28-day attribution window. On the contrary, if you undertake a comprehensive marketing strategy across different channels, then select the 1-day view window.

That’s because if you go for a 7-day or a 28-day window, Facebook is likely to take credit for more conversions and the stats provided by Facebook Ads Manager won’t match with that of Google Analytics. It is what it is and you can’t do anything about it!

Step 15:

Check the Website Purchases Conversion.

Step 16:

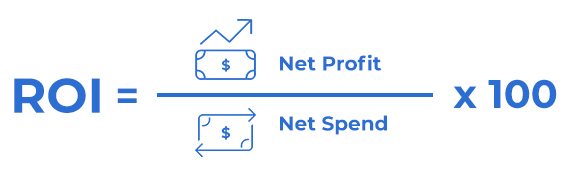

Now calculate ROI from Facebook. You can do that using the following formula:

For instance, say you spend $20 per day on ads for 4 days to promote a $50 product.

Let’s assume 100 people click on your ad, 50 of them head over to your website, 20 of them like your product but don’t finish the checkout process. And only 10 of those 100 buy that.

Total revenue generated based on the $80 ad spend is $500. So, the calculation for ROI will go like this:

Net profit = $500 – $80 = $420

Net Spend = $80

$420 / $80 x 100 = 525

Congrats! You’ve got a 525% ROI. That’s huge!

Note: In order to have successful Facebook ad campaigns, you should set a target for ROI that meets your financial expectations.

But there is a slight difference between ROI and ROAS that you should know.

ROI is the total revenue generated from a Facebook ad, which tells you if a campaign is profitable or not; ROAS (Return on Ad Spend) calculates gross revenue made from every penny spent on a marketing strategy. It focuses on how effective a campaign is in terms of generating impressions, clicks, and revenue.

So Why Should You Track ROI on FB Ads?

Let’s put it this way.

To determine whether a Facebook campaign is worth your time and investment.

If it’s helping you hit your financial goal, then double down on that one to make more money. That’s all there is to it!

Let’s face it, not all clicks on your ad are equal because they can (and will) attract a ton of never-going-to-convert leads. So, 10 converting leads are better for your business than a 100 non-converting leads. Therefore, it’s imperative for business owners to not drool over the 500 likes they get on an ad if the ad spend does not even at the breakeven, let alone make a decent ROI.

So if you don’t track Facebook ROI in the first place, there’s no way for you to know if your lead generation is spot on or if your balance sheet is positive or negative. And the last thing you would want in this case is to get hammered on your Facebook ad spend hoping to scale your business.

But you can use Google Analytics and Facebook Insights for a better understanding of ROI and measuring its social impact. But remember, some sales also occur offline that often go unnoticed. So how do you keep track of them? Keep reading to find the answer.

How To Use Facebook Insights to Measure ROI

Facebook Insights is a free tool that’s primarily used to measure Facebook ads ROI. It offers you a lot of insights into how your campaign performed in terms of social impact. For example, the number of new followers and likes you get this week compared to a week prior. It also gives information about overall engagement data, like comments, shares, followers’ activity on different posts, etc.

Besides that, it also helps you keep track of organic vs. paid traffic. To see these stats, click on the “Posts” tab under Insights. There you will see engagement on different posts, such as number of people who saw a post, the total number of clicks, likes, shares, comments, etc.

But your best bet is to check engagement on individual posts to get the most out of it. It will allow you to see how your ads performed compared to organic traffic and how that contributes to your long-term marketing goals.

Using Google Analytics to Measure ROI on FB Ad Spend

No doubt, Facebook Insights gives you an overview of a Facebook ad campaign. But when it comes to measuring engagement off Facebook, Google Analytics comes to the rescue!

When a user, say John, lands on your website through a Facebook ad and buys something, it’s an indirect Facebook ad ROI that you must calculate. I recommend using the URL tagging feature to build tags from Facebook and track all the Facebook campaigns individually. After building tags, you can check out web traffic on Google Analytics.

Navigate through Acquisitions > All Traffic. (Refer to steps 1-8 to see the step-by-step process). You will see the number of users who landed on your website through a Facebook ad. Moreover, it will also show you the duration of their stay, the web pages they visited, and if they purchased anything.

This process will help you analyze if your Facebook ad spend is worth an investment or not.

But Facebook Insights and Google Analytics Can’t Track Offline Sales

Alright! Not all conversions happen on Facebook or a website. I know.

Some business models make a huge lump sum of their front-end sales through a sales call. Take a high-ticket coaching business as an example. For such a business, Facebook Insights tells a ton about overall social engagement, and Google Analytics shows everything about off-Facebook marketing and conversion rate. But these two tools barely scratch the surface in terms of measuring offline ROI. Yeah, that’s right!

Because Facebook Insights does not offer a detailed analysis of advertising campaigns off Facebook. Besides that, exporting data from Facebook to evaluate these metrics doesn’t come in handy either. However, Google Analytics goes a step further and provides these benefits, but it cannot calculate offline sales that happen on a call.

So, when a high-ticket sales representative closes a deal on a call, Google Analytics does not record it regardless of how much ROI you generate from that.

Allow me to elaborate.

Say you close a $20,000 worth deal on a call after spending $500 on a Facebook ad. You’re getting a massive ROI of 3900%. But here’s the catch – neither Facebook Insights nor Google Analytics will record a dime of that sale.

So how do you tackle this situation? With the help of GA Connector!

How to Track ROI on Offline Sales Using GA Connector

The core feature of GA Connector is to save your leads’ information along with their tracking information into a CRM of your choice. This way, you can easily track which lead convert into a buyer on a sales call and measure offline ROI.

Therefore, it’s essential for business owners to have a tool like GA Connector set up to see if they’re achieving their financial goals.

This process is quite easy and takes only a few minutes.

- Click here to sign up for the FREE trial of GA Connector

- Select where you keep your leads – a premium CRM or an Excel shee

- Done and dusted!

Got a question? Feel free to send our team a message.